07 Nov A Recap on the Turkey’s Trade Defense Polıcy: 3rd Quarter of ‘22

İçindekiler

International trade, which plays a fundamental part in growth of global economy and competition, has been sustaining damage for a long time especially due to the Trade Wars initiated by USA in 2018 and the challenges came with Covid-19 pandemic. Governments are starting to show signs of inclination towards economic nationalism and utilizing the trade defense mechanisms. While such approach may ease the difficulties that domestic industries suffer due to recent developments in short term, consequences of restricting free trade in the long run should also be considered. It is clear that global economy has benefited from the liberalization of trade for a long time, thus straying away from it will surely present certain opportunity costs itself.

The key principle in international trade and what makes it beneficial to countries is the notion of “comparative advantage”. Comparative advantage, in layman’s terms, can be defined as a country’s ability to procure a good or service at a lower opportunity cost than another country that is its trading partner. According to the theory of comparative advantage, even though countries enjoy absolute advantage in the production of certain goods, trade can still be beneficial to both trading partners. However, for comparative advantage to be effectual, firstly, there must be free trade between countries without interruption. The General Agreement on Tariffs and Trade (“GATT”) comes into effect at this point. Updated in 1994, “GATT 1994”, aims to ensure the protection of free trade among contracting parties and prevention of any restraint on international trade.

Nevertheless, protection of free trade does not mean leaving the trade uncontrolled. Thus, there are trade defense measures envisaged for trading countries to utilize. One of these measures is regulated under Article VI of GATT 1994. Article VI, foresees anti-dumping measures which are; duties imposed onto imported products which are dumped into the country and cause material injury to the domestic industry. Basically, anti-dumping measures can be utilized as tools designed for governments to prevent importers from predatory pricing on large scales and protect their domestic industry. These measures regulated under Article VI have been explained and expanded with The Agreement on Implementation of Article VI of GATT (“AD Agreement”). Protection of free trade and enforcement of trade defense measures such as anti-dumping duties, are overseen by the World Trade Organization (“WTO”), established following the last round of the GATT (Uruguay Round of 1994).

Especially with the rise of protectionist approach in global economy, as a contracting party, Turkey has also adopted and utilized aforementioned anti-dumping measures in its trade defense policy. In order to prevent trade diversion caused by the Trade Wars and to support its domestic industry during current extra ordinaire economic situation, Turkish government puts its anti-dumping measures in use heavily. In this article, we will recap the recent developments in Turkey’s trade defense policy in the 3rd quarter of 2022.

Anti-Dumping Measures Repealed After an Expiry Review

Anti-Dumping Measures Against Glass Stoppers and Lids

Ministry of Trade (“Ministry”) has been imposing anti-dumping measures on imports of “stoppers, lids and other closures” originating in People’s Republic of China (“PRC”), Republic of Indonesia and Hong Kong since December 2003. Originally, the duties amounting to 0.91 USD/kg were imposed on the imports of concerned products originating in PRC, with the Communiqué No. 2003/22[1].

Conducting an expiry review in 2010, the Ministry expanded the measure’s scope over to products originating in Republic of Indonesia (0.14 USD/kg and 0.50 USD/kg) and Hong Kong (0.91 USD/kg), with the Communiqué No. 2010/12[2].

In its latest expiry review, the Ministry determined that dumping and damage on the domestic industry are not likely to continue or reoccur in the case that the anti-dumping duties on products originating from Republic of Indonesia and Hong Kong were repealed; thus concerned measures are lifted with the Communiqué No. 2022/13[3]. However, as a result of the expiry review investigation, it was decided that the anti-dumping duties on imports of concerned products originating in PRC need to continue; since it was found that repeal of said duties would result in continuation or reoccurring of dumping and damage. Therefore, while measures are lifted from the concerned products originating in Republic of Indonesia and Hong Kong, measures amounting to 0.52 USD/kg continue to be imposed on concerned products originating in PRC.

It should also be noted that, repeal of anti-dumping measures as a result of expiry review investigations are rare situations for the Ministry, as there is only 4 other cases like this in the last 10 years and the most recent repeal were in 2019.

Anti-Dumping Investigations Concluded Without Any Duties Imposed

Anit-Dumping Investigation On the Imports of Digital Printing Films

Upon a complaint lodged to the Ministry, an investigation was initiated against imports of “digital printing films” originating in Federal Republic of Germany on 27.05.2021. The complainant, a domestic producer, claimed that the imports of digital printing films originating in Federal Republic of Germany had been dumped and thereby caused injury and/or threat thereof to the relevant Turkish domestic industry.

In order to gather and evaluate information, the Ministry determined the period of investigation between 01.01.2020 and 31.12.2020 and period of injury between 01.01.2018 and 31.12.2020. During the investigation, conducted verification visits both to the domestic producer and the German producer’s branch located in Turkey, in order to verify the information submitted and determine whether there were any injury or threat thereof.

Evaluating the information provided and observations made; the Ministry found that, contrary to the claims put forward by the complainant, there has been no price undercutting or price underselling. The investigation revealed that, (i) imports of concerned products had been realized with unit prices that were 2-6% higher than the prices of the complainant and (ii) the complainant had reported high profitability during the period of investigation. Various economic indicators of the complainant displayed an improvement. While the production of the complainant showed a decrease, it appears that this stems from the decrease in export sales.

In light of this evaluations, the Ministry decided that the complainant had faced neither material injury nor threat thereof and thus the investigation shall be terminated without imposition of any anti-dumping duties, with the Communiqué No. 2022/18[4].

Expired and Expiring Anti-Dumping Measures

Anti-dumping measures are imposed for 5 years periods, and if any expiry review investigation is not initiated the measures expires and duties are repealed. In this context, the Ministry has announced the list for the anti-dumping measures in force which will expire in 2022 unless an expiry review investigation is initiated, with the Communiqué 2022/5[5].

Anti-Dumping Measures Against Concrete Pumps and Vehicles Designed For Them

In accordance, the anti-dumping measures on the imports of “concrete pumps” and “concrete pumping vehicles” originating in PRC and Republic of Korea are expired on 12.07.2022 since no expiry review investigation was launched.

Initially, as a result of an investigation, the Ministry determined that imports of concerned products originating in PRC and Republic of Korea were dumped and caused material injury on the domestic industry with the Communiqué No. 2017/18[6]. While certain interested parties based in mentioned countries cooperated with the investigation and received a lower duty imposed, general measures imposed were 11.63% CIF for Republic of Korea and 12.27% CIF for PRC. Cooperating parties received a considerable reduction with a duty amounting to 5.10% CIF. However, said measures are not in force anymore.

Anti-Dumping Measures Against Quilted Textile Products

Another anti-dumping measure expired is the duties imposed on imports of “quilted textile products” originating in PRC. Originally, the Ministry initiated an investigation in 2016 and as a result it determined that imports of concerned products originating in PRC had caused material injury on domestic industry. Hence, with the Communiqué No. 2017/22[7], an anti-dumping duty amounting to 17.29% of CIF had been imposed. Since there has been no expiry review investigation initiated, as it was announced with the aforementioned Communiqué No. 2022/5, the measure expired on 20.10.2022 and repealed.

Anti-Dumping Measures Against Certain Organic Chemicals

The Ministry, had launched and conducted anti-dumping investigations against the imports of certain organic chemicals, namely “Dioctyl Phthalate” and “Dioctyl Teraphthalate”, originating in Republic of Korea. Both investigations are concluded with the decision to impose anti-dumping measures on the concerned products in 2017 (Communiqué No. 2017/23[8] for Dioctyl Phthalate and Communiqué No. 2017/24[9] for Dioctyl Teraphthalate). The Ministry determined that imports of both products had caused material injury on domestic industry and ruled on imposition of anti-dumping duties amounting to 12.57% of CIF for both of them. Only LG Chem Ltd. had received reductions in the duties for both products, which came down to 7.99% of CIF for both concerned products. As there has been no expiry review investigation initiated, according to announcement made with the aforementioned Communiqué No. 2022/5, both measures expired on 20.10.2022 and repealed.

Concerned Products and Relevant Details Regarding Expiring Measures

Other anti-dumping duties that we can expect to be expired in 2022, unless an expiry review investigation is initiated, which listed in the aforementioned Communiqué 2022/5 are as follows:

Additionally, anti-dumping duties that we can expect to be expired in 2023, if no expiry review investigation is initiated, are listed in the Communiqué 2022/22[10] are as follows:

It should be mentioned that; as the abovementioned duties imposed on the imports of “unbleached kraftliners” originating in certain countries continues until 2023, an anti-dumping duty imposed on imports of the same products originating in USA with the Communiqué No. 2017/1[11] has expired on 14.04.2022 with the aforementioned Communiqué No. 2022/22.

The duties originally imposed in 2015 with the Communiqué No. 2015/28[12] as the concerned imports were found to be dumped and causing material injury on the domestic industry. Later, in 2016, the Ministry initiated an anti-circumvention investigation against the imports of concerned products and determined that; (i) the measures were circumvented via decreasing the export price of the concerned products and (ii) the measures should be imposed on unbleached kraftliners under 175 gr. Thus, the rate and scope of the duties were amended to 19.96% of CIF for general and 15.06% and 12.24% of CIF for two different cooperating firms.

Considering that an ongoing anti-dumping duty on the same products has expired without an expiry review, it can be assumed that abovementioned measure which will expire on 19.04.2023 is likely to expire without an expiry review as well.

Initiated Expiry Reviews

Anti-Dumping Measures Against Tubes And Pipes Of Refined Copper

The Ministry had conducted an investigation regarding the imports of “tubes and pipes of refined copper” originating in Hellenic Republic (“Greece”) in 2016. Evaluating the information and findings gathered during the investigation, the Ministry determined that imports of the concerned product is dumped and had caused material injury on the domestic industry. Thus, with the Communiqué No. 2017/25[13], an anti-dumping duty amounting to 9% of CIF had been imposed. Only one cooperating firm had been earned a discount on the duty imposed and received a duty amounting to 5% of CIF.

In this context, the mentioned measure was to expire on 17.10.2022, as it was announced on the aforementioned Communiqué No. 2022/5. However, upon a submission made to the Ministry, by a company who has the power to represent domestic industry, an expiry review investigation has been initiated with the Communiqué No. 2022/30[14].

Anti-Dumping Measures Against Flat Rolled, Hot Rolled Steel

Imports of “certain flat rolled, hot rolled steel products”[15], originating in PRC, were subject to an anti-dumping investigation in 2016. As the imports of concerned products were found to be dumped and causing injury to the domestic industry, with the Communiqué No. 201732[16] the Ministry ruled on the imposition of duties as follows; 22.55% of CIF for others and 16.89% of CIF for Jiangyin Xingcheng Special Steel Works Co. Ltd.

As the mentioned measure was to expire on 29.11.2022, an expiry review investigation has been initiated with the Communiqué No. 2022/31[17], upon a submission made to the Ministry, by a company who has the power to represent domestic industry.

Anti-Circumvention

Anti-Dumping Measures Against Certain Types of New Pneumatic Tires, of Rubber

It should be mentioned that, the abovementioned anti-dumping measures against the imports of “certain types of new pneumatic tires, of rubber”, which are about to expire, are currently under circumventing investigation. Originally, the Ministry imposed an anti-dumping duty on the imports of concerned products originating in PRC varying between 60 and 87% of CIF in 2005 with the Communiqué No. 2005/18[18]. Following, two expiry reviews had been conducted. With the latest expiry review investigation, which was in 2017, the Ministry decided on continuation of the said anti-dumping duties as of 60% of CIF with the Communiqué No. 2017/33[19].

In this context, the Ministry initiated an ex officio anti-circumvention investigation against the imports of concerned product originating in Malaysia on 10.09.2021 with the Communiqué No. 2021/42[20].

The Final Report on Anti-Circumvention within the scope of the mentioned investigation has been published by the Ministry on 16.08.2022[21].

Following, the Ministry concluded the said anti-circumvention investigation with the Communiqué No. 2022/32[22]. In this context, two firms cooperated by responding the questionnaires and submitting information duly in time. Mentioned firms are; Golden Horse Rubber Sdn. Bhd. (“Golden Horse”) and Continental Tyre PJ Malaysia Sdn. Bhd. (“Continental”). Evaluating the information provided by the Continental and Golden Horse, and the information gathered based on the available data, the Ministry concluded that:

- Although the cooperating firm Golden Horse procures all the raw material from the PRC, it was determined that they were not circumventing since the essential stages of the concerned product’s production are realized in Golden Horse’s facilities in Malaysia.

- The other cooperating firm Continental has been found not in violation as well. It was determined that they do not purchase significant amount of material from the PRC and realize all the stages of production in their own facilities in Malaysia.

- With respect to the other firms in Malaysia; the available data displays that; (i) Malaysia has a high production capacity for the concerned products, (ii) realize exports in substantial volumes globally and (iii) exports increased in general in 2020.

Thus, the Ministry ruled that the imports of concerned products originating in Malaysia do not cause circumvention of the ongoing duties levied on the imports originating in PRC, and there is no need for imposition of additional duties.

Anti-Dumping Measures Against Certain Types of Coagulated Imitation Leather

Initially, the Ministry enforced anti-dumping duties on the imports of “coagulated imitation leathers” with the following HS Code; 5603.14, originating in PRC with the Communiqué No. 2009/12[23] amounting to 1.9 USD/kg in 2009.

Following, the concerned measure is extended towards the imports of coagulated imitation leathers with the HS Code 3921.13 originating PRC as well; with the Communiqué[24] dated 16.10.2018.

With the latest expiry review investigation, the Ministry decided to continue imposition of mentioned duties on the concerned products as they are in 2021 with the Communiqué No. 2021/18[25].

The Ministry initiated an ex officio anti-circumventing investigation against the imports of concerned products originating in Malaysia and Hashemite Kingdom of Jordan (“Jordan”) in 2021[26]. The investigation has been notified and, relevant documents (such the Initial Report and Final Report) and information requests has been sent to the interested parties (such as the ministries of the concerned countries, exporting firms and domestic industry). As it is stated in the Information Report of the Ministry[27]; no cooperation submission has been made from the concerned countries, duly and in time. On the other hand, the domestic industry has submitted varying responses; as the Istanbul Apparel Exporters’ Association (“İHKİB”) mentioned that concerned countries circumvents the current anti-dumping duties and the domestic industry faces an unfair competition suppression, the Istanbul Leather and Leather Products Exporters’ Association (“İDMİB”) stated that it might be beneficial to temporarily lift the duties on the products with limited production in such times when medium and long term planning is hard.

Evaluating all the data and information provided and at hand, the Ministry determined that (i) the imports of the concerned products originating in Malaysia has displayed a significant increase in 2019 and 2020 and (ii) the imports of the concerned products originating in Jordan has displayed a significant increase in 2019, further it has been found that all export of the concerned products in Jordan has been made to Turkey. The Ministry ruled that; all the information demonstrates a circumvention of current anti-dumping measures since there are no sufficient and legitimate reason other than this.

Thus, the Ministry ruled that imports of concerned products originating in Malaysia and Jordan were circumventing the current anti-dumping measures and current measures shall also be imposed on the mentioned imports as well with the Communiqué No. 2022/15[28].

Anti-Dumping Measures Against Imitation Leathers Coated With Polyurethane

Imports of “certain imitation leather products coated with polyurethane” originating in PRC were the subject of an anti-dumping investigation in 2005 and the Ministry had ruled on imposition of anti-dumping measures on these products with the Communiqué No. 2005/2[29]. Said measures were as follows: (i) for the products with the CN Code 5903.20.10.10.00 and 5903.20.10.90.00 originating in PRC; 1 USD/kg and (ii) for the products with the CN Code 5903.20.10.00 and 5903.20.90.90.00 originating in PRC; 2.2 USD/kg. Said measures currently continues as they are. However, it should be mentioned that they are under an expiry review investigation at the moment.

The Ministry initiated an ex officio anti-circumventing investigation against the imports of concerned products originating in Malaysia and Greece in 2021[30]. The investigation has been notified and, relevant documents (such the Initial Report and Final Report) and information requests have been sent to the interested parties (such as the ministries of the concerned countries, exporting firms and domestic industry). Malaysian Ministry of International Trade and Industry (“MITI”), initially claimed that the domestic industry were not harmed and sufficient information were not shared. However, the MITI did not submit a response to the Final Report.

As it is stated in the Information Report of the Ministry[31]; no cooperation submission has been made from Greece, duly and in time. On the other hand, Innotech Textile (M) Sdn. Bhd. (“Innotech”) and Klarge Artificial Leather and Textile (M) Sdn. Bhd. (“Klarge”), located in Malaysia, have responded to the Questionnaires. While Innotech fulfilled the request of missing information, Klarge did not submit the missing information requested. Therefore, Innotech were acknowledged as a cooperating firm and Klarge were not.

Evaluating all the data and information provided and at hand, the Ministry determined that (i) the imports of the concerned products originating in Malaysia has displayed a significant increase in period of investigation and (ii) the unit prices of the concerned products were under the unit prices of product originating in PRC between 2018 and 2020.

With respect to the imports of the concerned products originating in Greece, the Ministry found that; the imports increased consistently during the period of investigation, especially in 2020 the imports increased by 18 times and the prices of the imports stayed under the general prices of imports. Since there was no submission made by a firm located in Greece, the Ministry ruled that; all the information demonstrates a circumvention of current anti-dumping measures since there are no sufficient and legitimate reason other than this.

Thus, the Ministry ruled that imports of concerned products originating in Malaysia and Greece were circumventing the current anti-dumping measures and current measures shall also be imposed on the mentioned imports as well with the Communiqué No. 2022/16[32]. However it should be mentioned that, cooperating firm Innotech has received an immunity for the imports of products with the CN Code 5903.20.90.90.00 as it has been determined that they produce the concerned product in their own facilities and do not have any circumventing activity.

Imposition of Anti-Dumping Measures

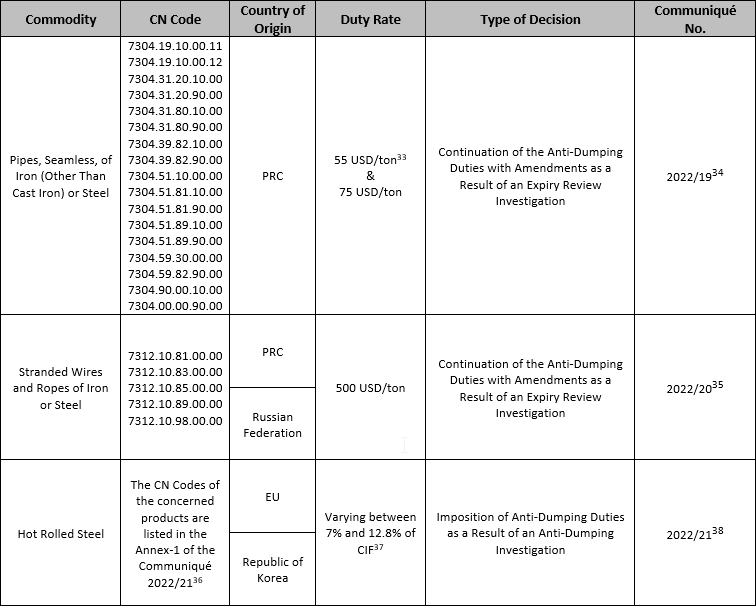

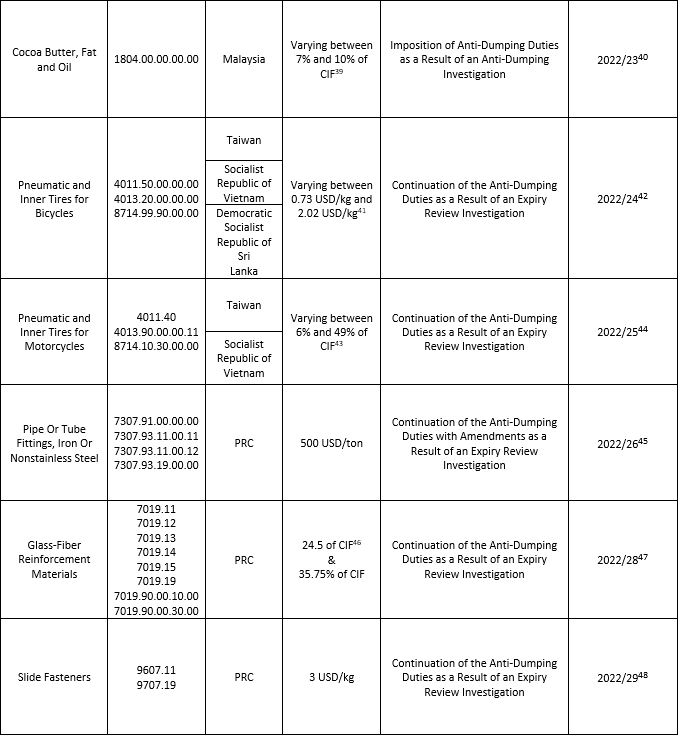

Details regarding the anti-dumping duties that are imposed or continued in the third quarter of 2022 by the Ministry are provided the table below:

Safeguard Measures

Alongside with anti-dumping measures and countervailing measures, WTO members have a third option to protect fair trade, which is safeguard measures. Safeguard measures can be defined as “emergency” actions for protecting the domestic industries from increased imports of particular products, where such imports have caused or threaten to cause serious injury. Such measures, which in broad terms take the form of suspension of concessions or obligations, can consist of quantitative import restrictions or of duty increases to higher than bound rates.

Different from anti-dumping measures, safeguard measures are not aimed at unfair trade practices, rather it provides Member States with a safety value for fair trade. Main intention of safeguard measures is to provide a temporary relief the domestic industry and an opportunity to adjust to increased import competition.

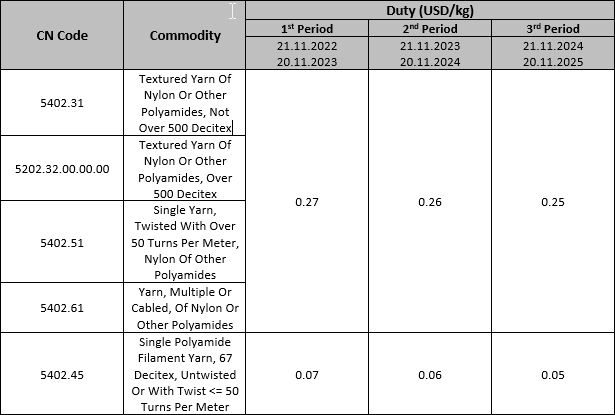

Safeguard Measures Against Synthetic Filament Yarn

While safeguard measures are not as often utilized as anti-dumping duties, they are not less beneficial. In this context, the Ministry concluded an investigation launched against imports of “synthetic filaments yarn of nylon or other polyamides” with the CN Codes 5402.3, 5402.32.00.00.00, 5402.45, 5402.51 and 5402.61 andruled on imposition of safeguard measures with the Communiqué No. 2022/3[49].

Originally, the safeguard measures, were imposed in 2019 and would be expired in 21.11.2022; however, as a result of the submission lodged by four domestic producers, an investigation had been launched. The domestic producers stated in their submissions that the safeguard measures on imports of synthetic filament yarn of nylon or other polyamides are still needed in order to protect the domestic industry.

Evaluating all the information and data gathered, the Ministry concluded in its Final Report[50] (which is annexed to the Communiqué No. 2022/3) that; (i) even though Covid-19 caused a temporary decrease in imports in 2020, there is a significant rise in 2019 and 2021, (ii) compared to the previous years, cheaper import products originating in countries with offensive export trends such as PRC, are even more introduced into the domestic market and (iii) time is needed for the investments made by the domestic industry to come to fruition.

Therefore, it has been decided that; the safeguard measures against concerned products should be continued for 3 more years. Said measures are as follows:

Conclusion

Looking at the trend of the Ministry’s trade defense instruments, it is safe to say that; in parallel with the global tendencies, Turkey is inclined towards a nationalist and protectionist economic position as well. Considering the burdens of Covid-19 on international trade and Turkey’s current economic situation, this approach might seem beneficial for the short term results. However, on the long run, it is a proven fact that free international trade is prosperous for everyone.

This activity of the Ministry in utilizing the trade defense instruments is also an indicator for companies that; with expert and efficient legal support, there are many legal procedures which can be used against unfair or unexpected competition. These trade defense instruments are designed by the law makers for the protection of the domestic industries, and they can be turned into an efficient competition strategy with the proper planning. Thus, right knowledge and counseling can relieve the competitive pressure on the companies.

[1] Communiqué No. 2003/22 on the Prevention of Unfair Competition in Imports, dated 20.12.2003.

[2] Communiqué No. 2010/12 on the Prevention of Unfair Competition in Imports, dated 23.05.2010.

[3] Communiqué No. 2022/13 on the Prevention of Unfair Competition in Imports, dated 13.05.2022.

[4] Communiqué No. 2022/18 on the Prevention of Unfair Competition in Imports, dated 10.06.2022.

[5] Communiqué No. 2022/5 on the Prevention of Unfair Competition in Imports, dated 11.02.2022.

[6] Communiqué No. 2017/18 on the Prevention of Unfair Competition in Imports, dated 12.07.2017.

[7] Communiqué No. 2017/22 on the Prevention of Unfair Competition in Imports, dated 20.10.2017.

[8] Communiqué No. 2017/23 on the Prevention of Unfair Competition in Imports, dated 20.10.2017.

[9] Communiqué No. 2017/24 on the Prevention of Unfair Competition in Imports, dated 20.10.2017.

[10] Communiqué No. 2022/22 on the Prevention of Unfair Competition in Imports, dated 04.08.2022.

[11] Communiqué No. 2017/1 on the Prevention of Unfair Competition in Imports, dated 07.03.2017.

[12] Communiqué No. 2015/28 on the Prevention of Unfair Competition in Imports, dated 14.07.2015.

[13] Communiqué No. 2017/25 on the Prevention of Unfair Competition in Imports, dated 17.10.2017.

[14] Communiqué No. 2022/30 on the Prevention of Unfair Competition in Imports, dated 12.10.2022.

[15] The CN Codes of the concerned products are as follows: 7208.51.20.10.11, 7208.51.20.10.19, 7208.51.20.30.11, 7208.51.20.30.19, 7208.51.20.90.11, 7208.51.20.90.19, 7208.90.80.10.11, 7208.90.80.10.12, 7208.90.80.20.11, 7208.90.80.20.12, 7211.13.00.11.00, 7211.13.00.19.00, 7211.14.00.21.12, 7211.14.00.29.11, 7211.14.00.29.12, 7225.40.40.00.00, 7225.99.00.00.10 and 7225.99.00.00.90.

[16] Communiqué No. 2017/32 on the Prevention of Unfair Competition in Imports, dated 29.11.2017.

[17] Communiqué No. 2022/31 on the Prevention of Unfair Competition in Imports, dated 25.11.2022.

[18] Communiqué No. 2005/18 on the Prevention of Unfair Competition in Imports, dated 20.05.2005.

[19] Communiqué No. 2017/33 on the Prevention of Unfair Competition in Imports, dated 02.12.2017.

[20] Communiqué No. 2021/42 on the Prevention of Unfair Competition in Imports, dated 10.09.2021.

[21] https://ticaret.gov.tr/data/6127ab2913b8760a7041c1be/Nihai%20Bildirim%20Raporu.doc

[22] Communiqué No. 2022/32 on the Prevention of Unfair Competition in Imports, dated 25.10.2022.

[23] Communiqué No. 2009/12 on the Prevention of Unfair Competition in Imports, dated 19.04.2009.

[24] Communiqué Amending the Communiqué No. 2015/9 on the Prevention of Unfair Competition in Imports, dated 16.10.2018.

[25] Communiqué No. 2021/18 on the Prevention of Unfair Competition in Imports, dated 28.05.2021.

[26] Communiqué No. 2021/43 on the Prevention of Unfair Competition in Imports, dated 04.09.2021.

[27] https://www.resmigazete.gov.tr/eskiler/2022/06/20220609-12-1.pdf

[28] Communiqué No. 2022/15 on the Prevention of Unfair Competition in Imports, dated 09.06.2022.

[29] Communiqué No. 2005/2 on the Prevention of Unfair Competition in Imports, dated 05.02.2005.

[30] Communiqué No. 2021/15 on the Prevention of Unfair Competition in Imports, dated 26.03.2021.

[31] https://www.resmigazete.gov.tr/eskiler/2022/06/20220615-5-1.pdf

[32] Communiqué No. 2022/16 on the Prevention of Unfair Competition in Imports, dated 15.06.2022.

[33] Exceptional rate for the following cooperating firms:

Hubei Xinyegang Special Tube Co., Ltd.,Hubei Xinyegang Steel Co., Ltd.,Shandong Haixinda Petroleum Machinery Co., Ltd.,Shandong Huitong Industrial Co., Ltd.,Jiangsu Changbao Steel Tube Co., Ltd.,Liaocheng Ritong Steel Co., Ltd.,Shandong Zhongzheng Steel Pipe Manufacturing Co., Ltd. and TianJin TianGang Special Petroleum Pipe Manufacture Co., Ltd

[34] Communiqué No. 2022/19 on the Prevention of Unfair Competition in Imports, dated 09.07.2022.

[35] Communiqué No. 2022/20 on the Prevention of Unfair Competition in Imports, dated 09.07.2022.

[36] https://www.resmigazete.gov.tr/eskiler/2022/07/20220707-15-1.pdf

[37] The rates for products originating in EU are as follows:

- 10.9% of CIF for: Acciaierie d’Italia S.P.A, ArcelorMittal Belgium N.V., ArcelorMittal Bremen GmbH, ArcelorMittal Eisenhüttenstadt GmbH, ArcelorMittal France SAS, ArcelorMittal Méditerranée SAS, ArcelorMittal Poland S.A., ArcelorMittal Sagunto S.L., ArcelorMittal Sestao S.L., ArcelorMittal Asturias S.A.

- 7% of CIF for: Tata Steel Ijmuiden BV

- 8.95% of CIF for: Liberty Galati S.A., Liberty Ostrava a.s., Thyssenkrupp Steel Europe AG, Thyssenkrupp Hohenlimburg GmbH and

- 12.8% of CIF for Others.

The rates for products originating in Republic of Korea are as follows:

- 7% of CIF for: Posco, Hyundai Steel Company

- 8.95% of CIF for Others.

[38] Communiqué No. 2022/21 on the Prevention of Unfair Competition in Imports, dated 07.07.2022.

[39] The rates for products are as follows:

- 8.5% of CIF for: Barry Callebaut Manufacturing Malaysia Sdn Bhd

- 7% of CIF for: Guan Chong Cocoa Manufacturer Sdn Bhd

- 7.5% of CIF for: GCB Cocoa Malaysia Sdn. Bhd.

- 7.5% of CIF for: JB Coca Sdn Bhd

- 10% of CIF for Others.

[40] Communiqué No. 2022/23 on the Prevention of Unfair Competition in Imports, dated 21.09.2022.

[41] The duties for the concerned products are as follows (they are all imposed equally to all concerned countries):

- 0.73 USD/kg for the Pneumatic Tires on Bicycles with the CN Code 4011.50.00.00.00

- 2.02 USD/kg for the Inner Tires on Bicycles with the CN Code 4013.20.00.00.00

- 0.73 USD/kg for the Bicycle Parts for Pneumatic Tires with the CN Code 8714.99.90.00.00

- 2.02 USD/kg for the Bicycle Parts for Inner Tires with the CN Code 8714.99.90.00.00

[42] Communiqué No. 2022/24 on the Prevention of Unfair Competition in Imports, dated 05.10.2022.

[43] The duties for the concerned products are as follows (they are all imposed equally to all concerned countries):

- as per the Pneumatic Tires on Motorcycles with the CN Code 4011.40; 6% of CIF for products originating in Taiwan and 29% of CIF for the products originating in Vietnam

- as per the Inner Tires on Motorcycles with the CN Code 4013.90.00.00.11; 21% of CIF for products originating in Taiwan and 49% of CIF for the products originating in Vietnam

- as per the Motorcycles Parts for Pneumatic Tires with the CN Code 8714.10.30.00.00; 6% of CIF for products originating in Taiwan and 29% of CIF for the products originating in Vietnam

- as per the Motorcycles Parts for Inner Tires with the CN Code 8714.10.30.00.00; 21% of CIF for products originating in Taiwan and 49% of CIF for the products originating in Vietnam

[44] Communiqué No. 2022/25 on the Prevention of Unfair Competition in Imports, dated 08.10.2022.

[45] Communiqué No. 2022/26 on the Prevention of Unfair Competition in Imports, dated 08.10.2022.

[46] Exceptional rate for the cooperating firm: Chongqing Polycomp International Corporation(CPIC)

[47] Communiqué No. 2022/28 on the Prevention of Unfair Competition in Imports, dated 18.10.2022.

[48] Communiqué No. 2022/29 on the Prevention of Unfair Competition in Imports, dated 22.10.2022.

[49] Communiqué No. 2022/3 on Safeguard Measures in Imports, dated 19.10.2022.

[50] https://www.resmigazete.gov.tr/eskiler/2022/10/20221019-15-1.pdf.